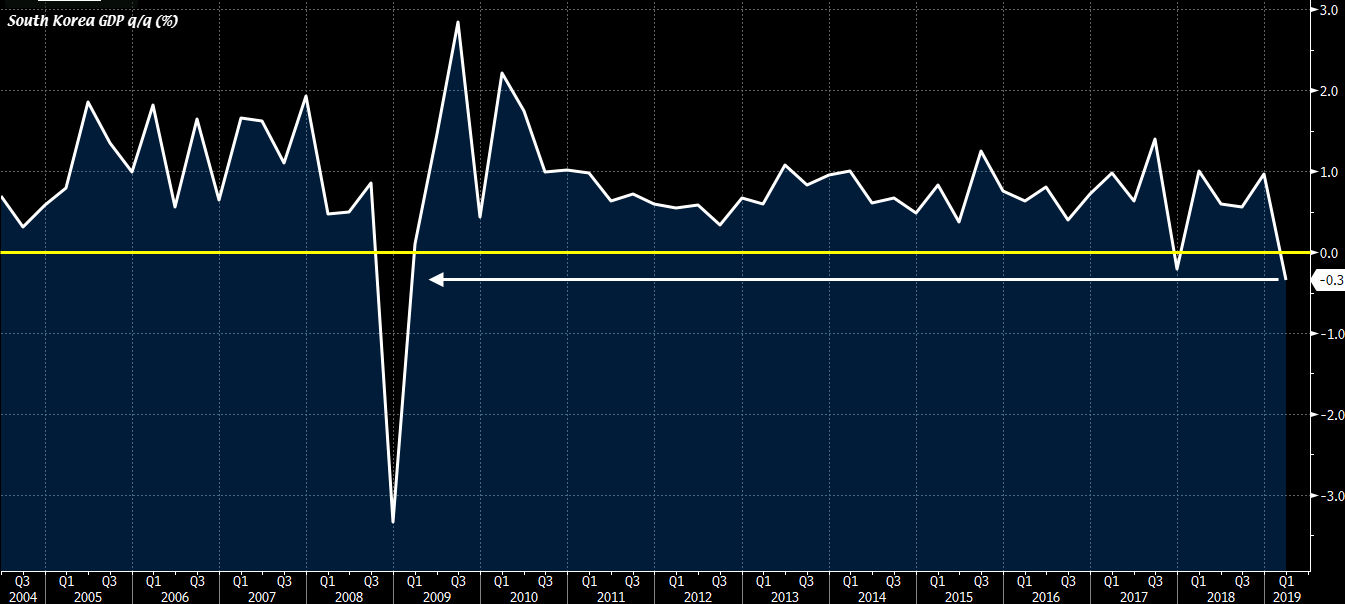

South Korea’s economy contracts at its fastest pace since Q4 2008 in the first quarter of this year

If you’re wondering why South Korea is seen as a bellwether for global trade, it is because data from the country tends to be released among the earliest in developed markets and also the fact that South Korea is a key link in global supply chains. Hence, that makes economic data releases from the country a precursor for what markets should expect of the health of the global economy.

Although a slowdown in global economic conditions in Q1 is very much something markets are getting used to by now, April data for South Korea isn’t faring much better. 20-day exports data show a decline of nearly 9% compared to exports in April last year, as global demand continues to show further signs of weakness. In March, the 20-day exports data only declined by 5% year-on-year.

With exports demand still waning to begin Q2, there’s no doubt this will translate to similar sentiment across other major economies as well. I still believe markets are a bit too complacent in reacting to the global economic landscape for the time being as the impending US-China trade deal and better earnings results are blindsiding market participants from the fact that the health of the global economy is still deteriorating.

I reckon this will be a key theme to watch out for in 2H 2019 especially if the much hoped and much awaited global economic rebound is seen to falter.