#SPX | More than 74% of stocks closed above their 200dma , the most since February 2018

Netflix has lowered its borrowing costs and increased the size of its new bond deal being sold to investors today, reflecting strong demand for the streaming giant’s debt.

The company is looking to sell $900m of bonds with a coupon of 5.375 per cent, up from initial expectations of $750m at 5.63 per cent, according to people familiar with the details. There will also be a €1.2bn bond at 3.88 per cent. Both slugs of debt are expected to have a maturity of 10.5 years.

In a statement, Netflix said it would use the money in part to buy and make content as it seeks to fend off looming competition in the streaming video market it pioneered. Disney, Apple, AT&T’s WarnerMedia and Comcast are all plotting streaming services to debut in the coming year.

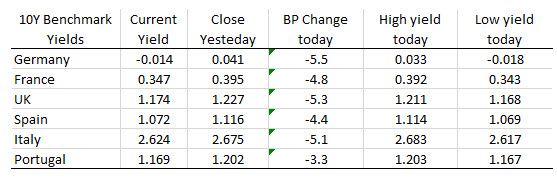

in the benchmark 10 year note sector fields were sharply lower with the German DAX down -5.5 basis points and closing back below the 0.0% level.

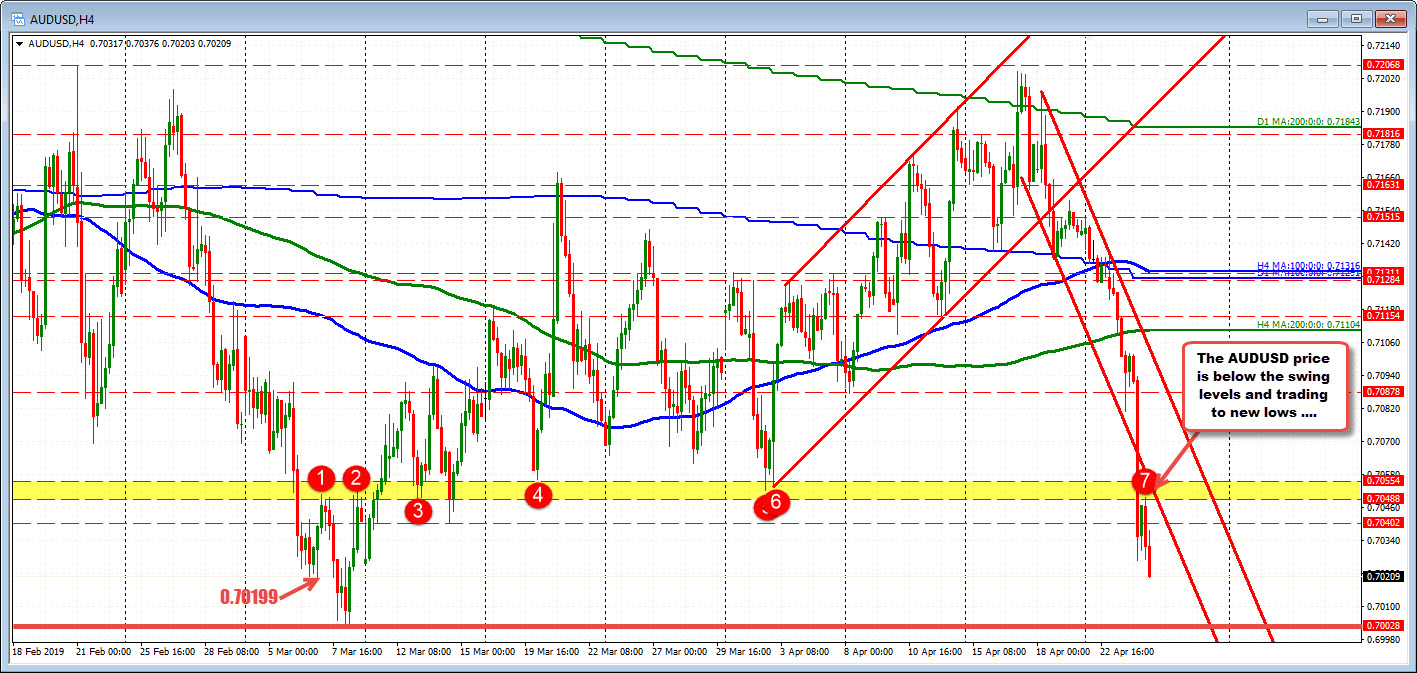

Asian stocks are not really following their US counterparts as equities are struggling in trading today. I reckon a stronger dollar overnight and concerns about the PBOC refraining from monetary easing is helping to play a role here.