Archives of “April 22, 2019” day

rssIran in “intensive” talks with partners as US to end waivers

No other details.

There is a news headline saying that “Iran in ‘intensive’ talks with partners as US to end waivers”.

Meanwhile, Turkey has criticized US decision to end Iranian oil waivers. They said it would not help with regional peace and stability.

…and

Iraq has also said that it is ready to increase oil exports by 250K based on the needs of the market.

A ‘powerful backbench figure’ will demand Theresa May resign tomorrow – report

Report from the Mail on Sunday

Harry Cole, deputy political editor at the Mail on Sunday, says a former Theresa May loyalist and ‘powerful backbench figure’ will be going public on Tuesday morning to demand that Theresa May resigns.

UK politics has been quiet for the past week because of Easter but the cannons will be firing again in the day ahead.

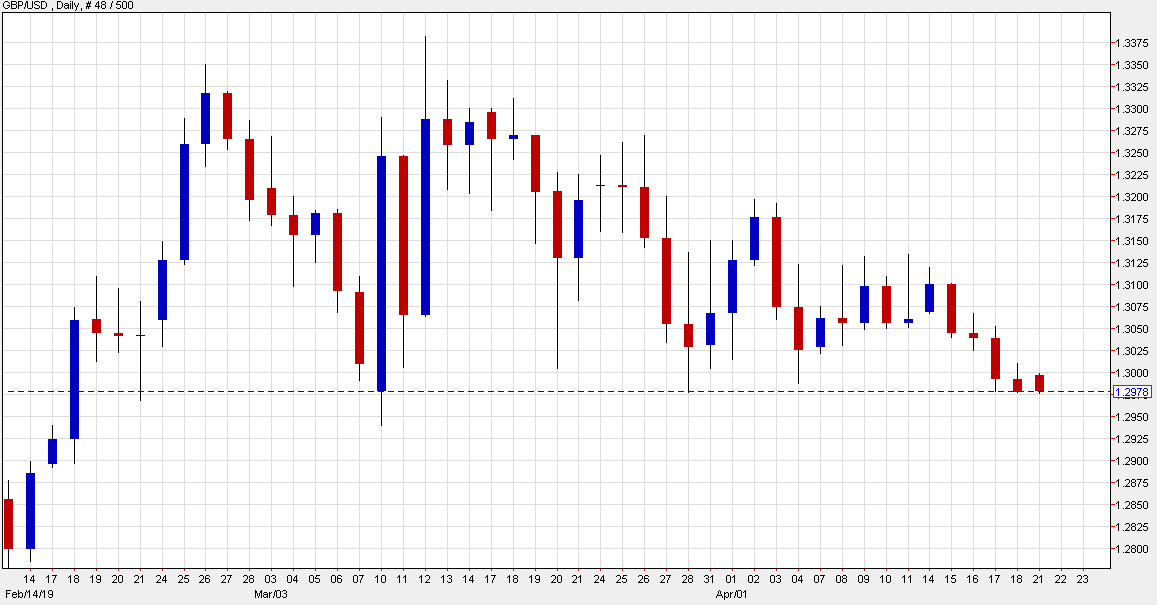

Cable is at session lows, down 15 pips to 1.2978, threatening Friday’s low of 1.2976.

Brent crude takes out a big level on Iran sanctions news

Brent rises above 61.8% retracement of the Q4 plunge

I love it when a major level breaks on big news. It’s the ultimate confirmation and it’s even better when the level falls convincingly after consolidating below it.

That’s exactly what has taken place in Brent crude. It had been consolidating below the 61.8% retracement level for the past two weeks before it shot higher today on the US cutting off Iran exports.

The breakout could be a big one. US talk about Saudi Arabia producing more rings hollow. The Saudis want $80 oil to balance their budget and help the long-term transition away from crude. This is their opportunity to pump a bit more while keeping prices at high levels.

I expect fresh momentum to the upside now but the risks are for an even faster appreciation if Iran follows through on a threat to close the Strait of Hormuz.

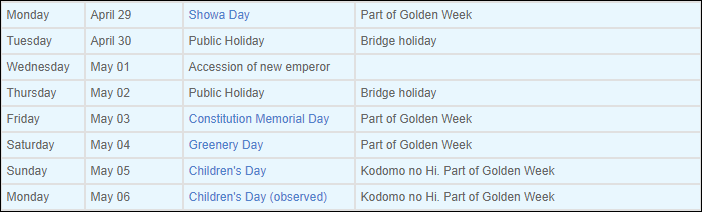

Heads up: More market holidays still to come

apanese markets will be set for a brief hiatus from next week onwards

Japan will be away for a 10-day break in total after the end of this week. Now, that’s what you call a long weekend. As such, be prepared for potential hedging flows throughout this week and a lack of liquidity during Asian to early European trading during the break period (remember the flash crash at the start of the year?).

As an aside, Australia and New Zealand will also be on break this Thursday in observance of Anzac Day so just be wary of lighter flows on that day during Asian trading this week.

S&P 500 corporate income tax rate… Q1 2016: 27.9% Q4 2018: 13.2%

Colombo Stock Exchange suspends trading after Sri Lanka attacks

The Colombo Stock Exchange will not open at its usual time on Monday following a series of bombings in Sri Lanka on Sunday that killed more than 200 people.

Sri Lanka was placed under a nationwide curfew on Sunday after bombs killed around 207 people at churches and hotels on Easter Sunday in the most lethal violence since the end of the country’s civil war in 2009. Ruwan Wijewardene, the defence minister, said 13 people had been detained in connection with the blasts.

The exchange said that following a consultation with the Securities and Exchange Commission of Sri Lanka in the wake of the attacks and a curfew imposed on the country that the market would not open on Monday for the safety and security of market participants.

“The SEC in consultation with the CSE will perform an ongoing assessment of the conditions necessary for an orderly conduct of the market, and will issue further communications as appropriate,” the statement said.

US will announce complete cutoff to Iran oil exports on Monday – report

Bullish news for oil as the US gets aggressive with Iran on oil

The US will no longer waive Iran sanctions for certain importers, the Washington Post reports.

The news should be a large tailwind for crude prices this week as the US gets serious in efforts to limit Iran’s exports, and cut them to near zero. In September of 2018 the US was expected to be tough but ultimately granted broad waivers in a move that caused the Q4 plunge in crude prices.

This time this US isn’t backing down.

Here are the forex centres open and closed in Asia today, Monday 22 April 2019

Its a holiday for many of the major FX trading centres in Asia today.

Closed;

- New Zealand

- Australia

- Hong Kong

Open:

- Japan

- Singapore

Normal trading begins again on Tuesday in the region, everyone is back open.

I’ll be taking a break today but will pop in with anything of note from time-to-time.

Thought For A Day