Archives of “April 16, 2019” day

rssEuropean shares close higher on the day led by the German Dax.

German Dax up 0.7%

- German DAX, +0.7%

- France’s CAC, +0.4%

- UK’s FTSE, +0.5%

- Spain’s Ibex, +0.1%

- Italy’s FTSE MIB, +0.12%

- Germany 0.063%, +0.7 basis points

- France 0.420%, unchanged

- UK 1.22%, unchanged

- Spain 1.085%, unchanged

- Italy 2.593%, +1.5 basis points

- spot gold is down $12.85 or 1% at $1275

- WTI crude oil futures are up $.15 or 0.24% at $63.56

- S&P index of 2.3 points or 0.08% at 2908

- NASDAQ index of 21.6 points or 0.27% at 7997.93

- Dow industrial average is up 51.87 points or 0.20% at 26435.59

- 2 year 2.404%, +1.2 basis points

- 5 year 2.399%, +2.7 basis points

- 10 year 2.585%, +3.1 basis points

- 30 year 2.9903%, +2.2 basis points

BAML’s April Global Fund Manager Survey shows short European equities as the most crowded trade.

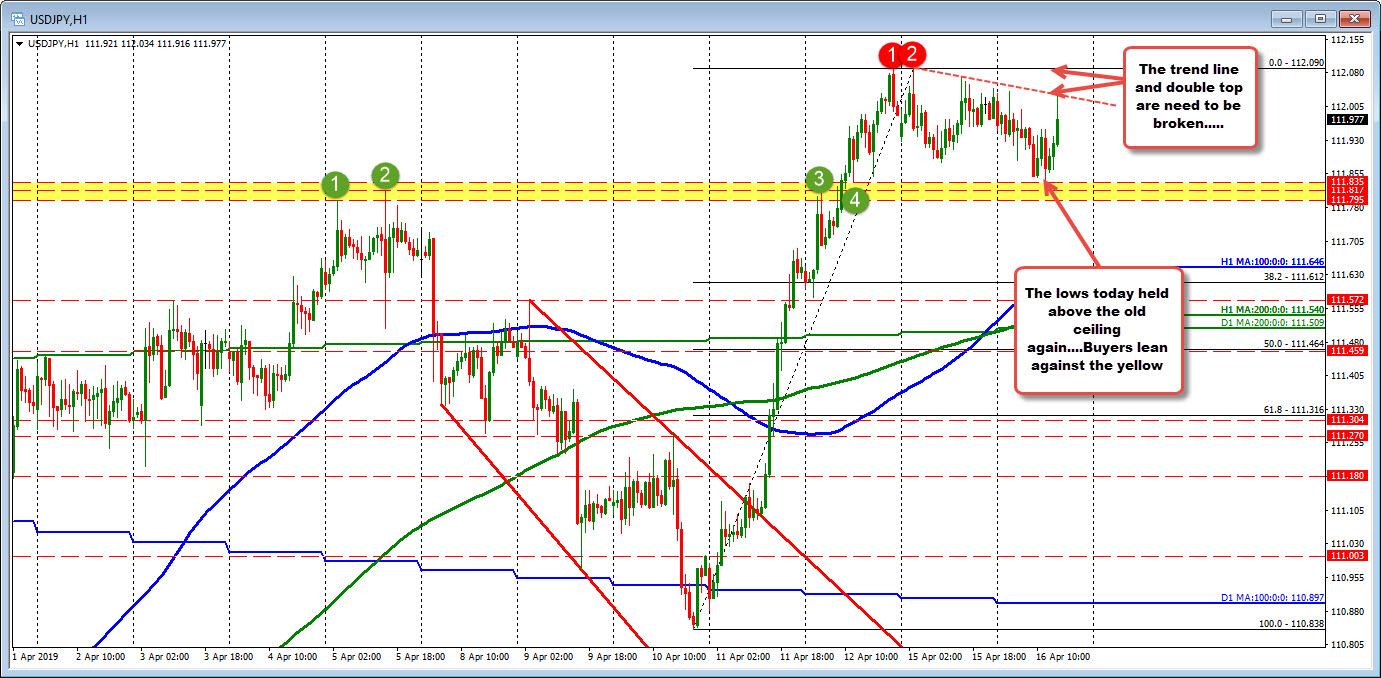

USDJPY – at the lows today – held above the old ceiling. Buyers remain in control.

Buyers and sellers are battling

The USDJPY is also in a down and up market as the pair continues to consolidate the sharp move up at the end of the week last week (from 110.838 to 112.09). The pair since the high has traded down of 111.835. That is just above the old ceiling at 111.79-817 area. Support held and the price moved back higher.

JPM EM FX Index below Ichimoku Cloud & 55 EMA

Gold takes out the March lows and nears the worst levels of the year

What’s driving the gold market right now

Nikkei 225 closes higher by 0.24% at 22,221.66

Tokyo’s main index stays buoyed above its 200-day moving average

Rio Tinto cuts 2019 iron ore outlook on cyclone damage

Rio Tinto cut its 2019 guidance for shipments of iron ore to between 333 and 343m tonnes on Tuesday as a result of cyclone damage at its port in Western Australia.

The Anglo-Australian miner shipped 69.1m tonnes of the commodity used to make steel in the first quarter, down 14 per cent year on year, following weather disruptions in March and a fire at its Cape Lambert A port facility, the company said.

“Our iron ore business faced several challenges at the start of this year, particularly from tropical cyclones,” said Rio chief executive J-S Jacques, adding that the guidance for Pilbara shipments had been reduced.

The miner said earlier this month that it expected iron ore shipments for 2019 would come in at the lower end of its previous guidance of 338 to 350m tonnes.

Iron ore prices have climbed this year after Vale cut operations in Brazil following a dam accident in January that killed almost 300 people.

Macron vows to rebuild Notre-Dame

French President Emmanuel Macron vowed to launch a campaign to rebuild Notre-Dame cathedral in central Paris, even as a devastating fire continued to ravage one of the world’s best known religious and cultural monuments.

“We were able to build this cathedral more than 800 years ago and over the centuries to enlarge it and improve it, and I tell you very solemnly this evening, this cathedral — we will rebuild it, all together,” he said in front of the famous twin towers on the Ile de la Cité in central Paris shortly before midnight on Monday. Mr Macron said a national fund would be launched tomorrow.

“Notre-Dame de Paris is our history, our literature, the life of our imagination, the place where we have lived all our great moments, our epidemics, our wars, our liberations, it’s the epicentre of our life,” he said, “It’s a cathedral of all the French even when they have never been to it. This history is ours, and it is burning.”

Fed – If Powell hikes before the 2020 election, pressure to resign will be great (does he care?)

Here is interesting though from an analyst on Fed credibility, political pressure and more.

- Trump has continually slammed the central bank, and particularly Powell …. “If they were ever to increase rates, God forbid, before the November 2020 elections, I think the drumbeat to try to get … [Powell] out of office would be great,”

- “It is not as if the president can fire the Fed chairman. He cannot. But he can make it extremely uncomfortable to occupy that position,”

- And:

- Sri-Kumar thinks the Fed loses credibility when it doesn’t recognize that it made an error, pointing to Powell’s “pivot” in January, just weeks after the central bank suggested two hikes for 2019.