#OIL: Monthly OECD inventory with a % of TTM global demand

And if we add unfunded liabilities and derivatives, total debts and liabilities amount to over $2 quadrillion which is 25x global GDP. This is not going to end well.

Liquidity is not the driver of this everything rally. Hope is. Not even massive global QE can prevent asset bubbles from bursting. See 2007-8 scenario below.

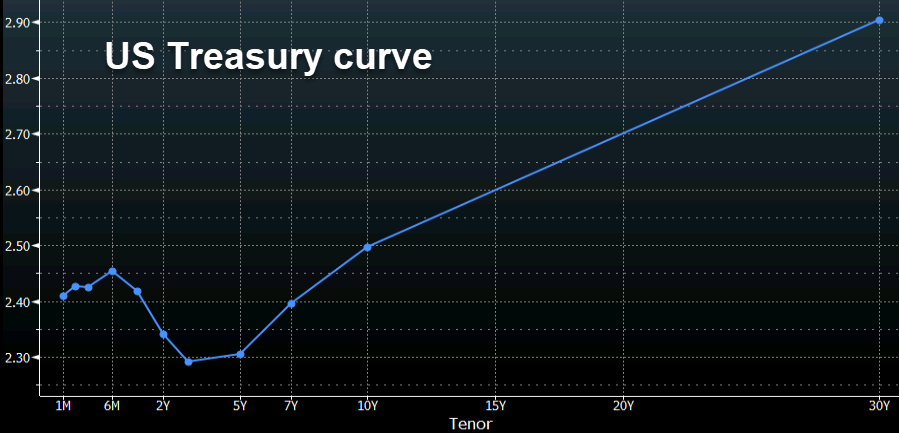

US 10 year Treasury yields touched a 14-month low in late March as concerns mounted regarding the trajectory of the Federal Reserve. This article is for you if you have been reading about the inverted yield curve in US Treasuries, but haven’t really understood what it means. Don’t worry if that is the case since one of the most often overlooked areas for FX traders is the impact the bond markets have on the FX sphere. However, it is an important area to master and not understanding why the inversion on bond yields is so important can be a major barrier in fundamental knowledge of the underlying financial forces at play in the equity, fx sphere and beyond. So, if you need a heads up on the inversion of the yield curve, and why it matters so much, read on. We will start with an explanation of what a bond actually is.

Firstly, understanding the basics of what a bond is

Think of a bond as simply a type of loan. It is a loan taken out by Governments and companies. When Governments and very large companies want to borrow money they can’t easily go to a bank because of the huge amounts of money involved. So, a bond is the mechanism by which a Government or large corporation borrows money for their needs.The bond is issued for a set period of time. Bonds can be purchased for different lengths of time from short term, medium term and long term bonds. Short term bonds are only for a year or two, medium term bonds are up to 10 years and long term bonds are generally 10 years or longer. These bonds have a coupon or yield rate.

Secondly, understanding what a yield is on a bond (more…)