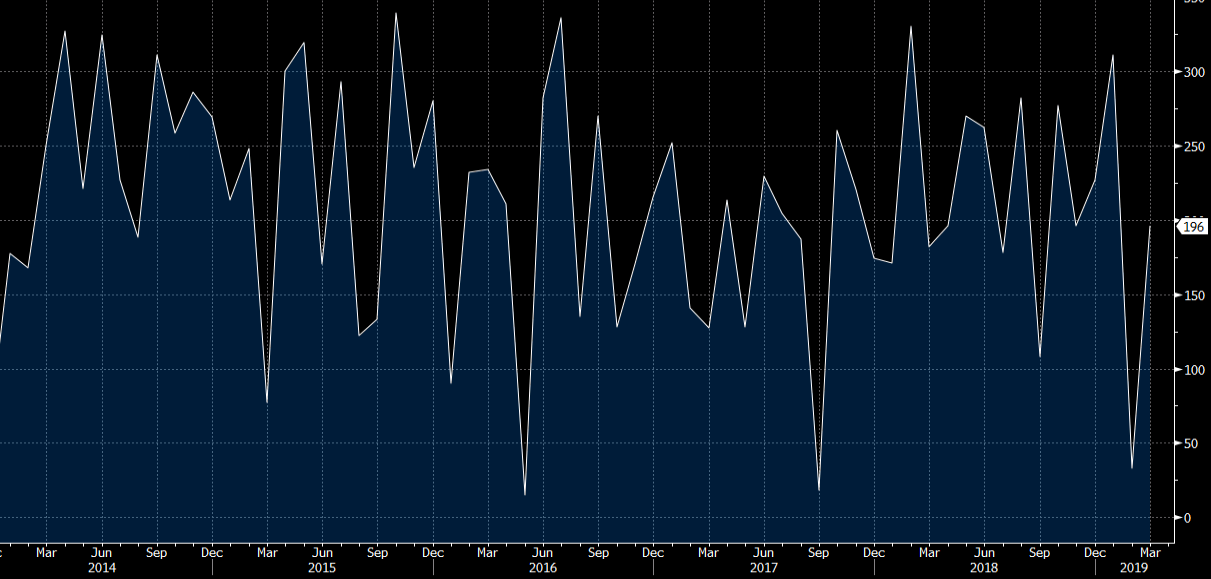

Non-farm payrolls for March 2019

- Prior was +20K (revised to +33K)

- Estimates ranged from 145K to 277K

- Two month net revision +14K

- Unemployment rate 3.8% vs 3.8% expected

- Participation rate 63.0 vs 63.2% prior

- Avg hourly earnings +0.1% vs +0.3% exp

- Avg hourly earnings +3.2% y/y vs +3.4% exp

- Private payrolls +182K vs +177K exp

- Manufacturing -6K vs +10K exp (first decline since Oct 2016)

- U6 underemployment 7.3% vs 7.3% prior

The headline number will relieve a bit of angst after the poor February print but the earnings numbers are poor. For stock markets, this is a bit of a goldilocks number because you have a decent economy without the threat of hikes because of rising wages. However, it’s a negative for the dollar because it underscores that the Fed is done hiking for the cycle.