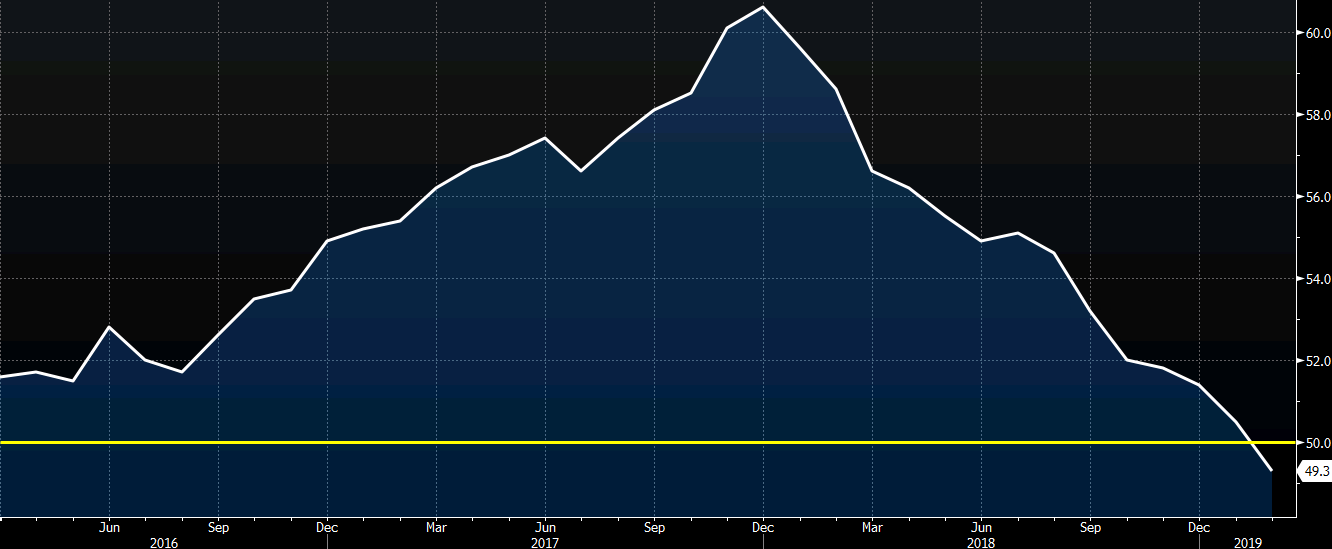

Down on the week

The price of crude oil futures are settling at $55.80 for the day/week. That is down $1.42 or 2.48%. For the week, the price is down from last week’s close at $57.26 which is about the amount of the decline today.

The high for the week reached was reached today at $57.88. The low was at $55.02 reached on Tuesday. Technically, the price this week traded above and below its 100 day MA- currently at $56.05 (blue line in the chart below). Today’s move kicked the pair below that level.