Thought For A Day

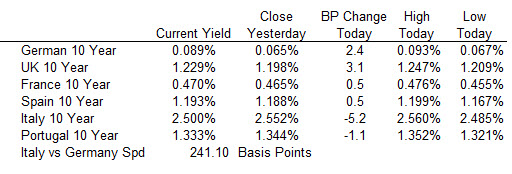

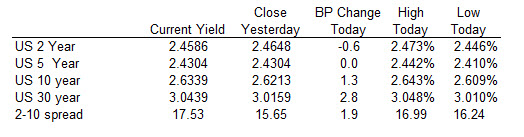

US yields are showing a steepening of the yield curve today with the 2 year down -0.6 bps and the 30 year up 2.8 bps.

US yields are showing a steepening of the yield curve today with the 2 year down -0.6 bps and the 30 year up 2.8 bps.

Shell’s chief executive Ben van Beurden received a bumper 126 per cent pay increase for 2018, taking his total remuneration to €20.14m.

The increase, from €8.9m, is largely due to a significant payout under the oil major’s long-term incentive plan (LTIP). Mr van Beurden received €15.2m under the LTIP for 2018 compared to €4m a year earlier.

The sizeable increase will no doubt draw criticism from campaigners against high boardroom pay. Mr van Beurden’s pay is 143 times that of the average Shell employee’s salary.

Shell acknowledges in its annual report that its remuneration committee is “sensitive to the wider societal discussions regarding the level of executive pay and spent a significant amount of time discussing the high single figure for the CEO in 2018”.

However, the committee’s chairman, Gerard Kleisterlee, said it took into account the company’s performance over the past three years, which has included completing the acquisition and integration of BG, a $30bn divestment programme and the creation of Shell’s “new energies” business taking the oil major further into renewables as well as investing in electric vehicle charging and domestic electricity and gas supply. (more…)

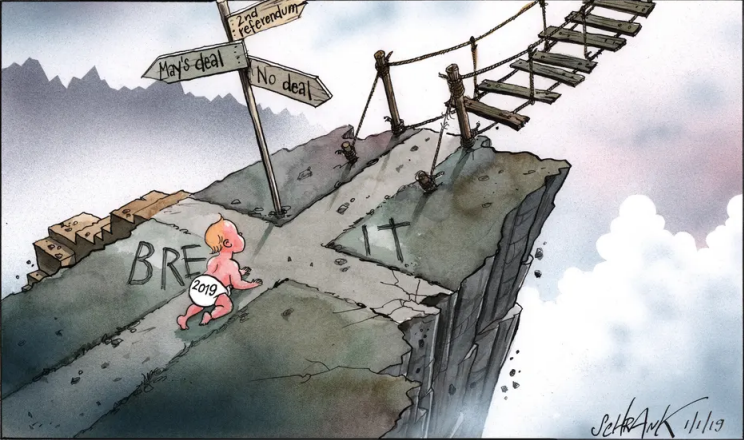

The change in odds come after the no-deal votes yesterday following comments by the firm that a third vote on May’s Brexit deal is likely. They now see a 60% probability that May will get her Brexit deal ratified while saying that there is a “considerable chance” that Brexit will still be reversed through a second referendum.