Those hoping for a respite in the sell-off in emerging market stocks were left disappointed on Monday.

The MSCI Emerging Market Index — a benchmark for developing country equities — fell for a second straight session, dropping 1.2 per cent to 1,046.49 as concerns over sputtering global economic growth continued to unsettle investors.

Monday’s decline — which adds to a 0.9 per cent fall on Friday — threatens to drag the gauge back below its 50-day moving average, a key short-term momentum level often watched by traders. The last time the index fell below its 50-DMA, which sat at around 1,040 on Monday, was in early January.

The flight from risk — which also drove a sharp rally in sovereign bonds — took hold on Friday after a run of surprisingly weak eurozone economic data and the inversion of a closely watched part of the Treasury yield curve triggered fears of a deepening slowdown.

The sell-off reached Asia in full force on Monday, with mainland China’s CSI 300 tumbling 2.4 per cent and Hong Kong’s Hang Seng sliding 2.2 per cent.

The two-day decline effectively wiped out the boost the Federal Reserve gave to the MSCI EM index last week when — in a more dovish than expected policy shift — it ruled out further rate hikes this year and announced plans to halt its balance sheet shrinkage by September.

“The sell-off validates our scepticism that a dovish Fed will be sufficient for capital inflows into risky assets witnessed over the past few months to prove sustainable,” said Rabobank in a note to clients on Monday.

“We believe this is especially so considering the outlook for the global economy is clouded by uncertainties caused by trade tensions, Brexit and prevailing vulnerabilities in various emerging markets.”

Adding to the macroeconomic headwinds are country specific issues — including fresh economic turmoil in Turkey and political developments in Brazil that threaten to derail the new president’s reform agenda.

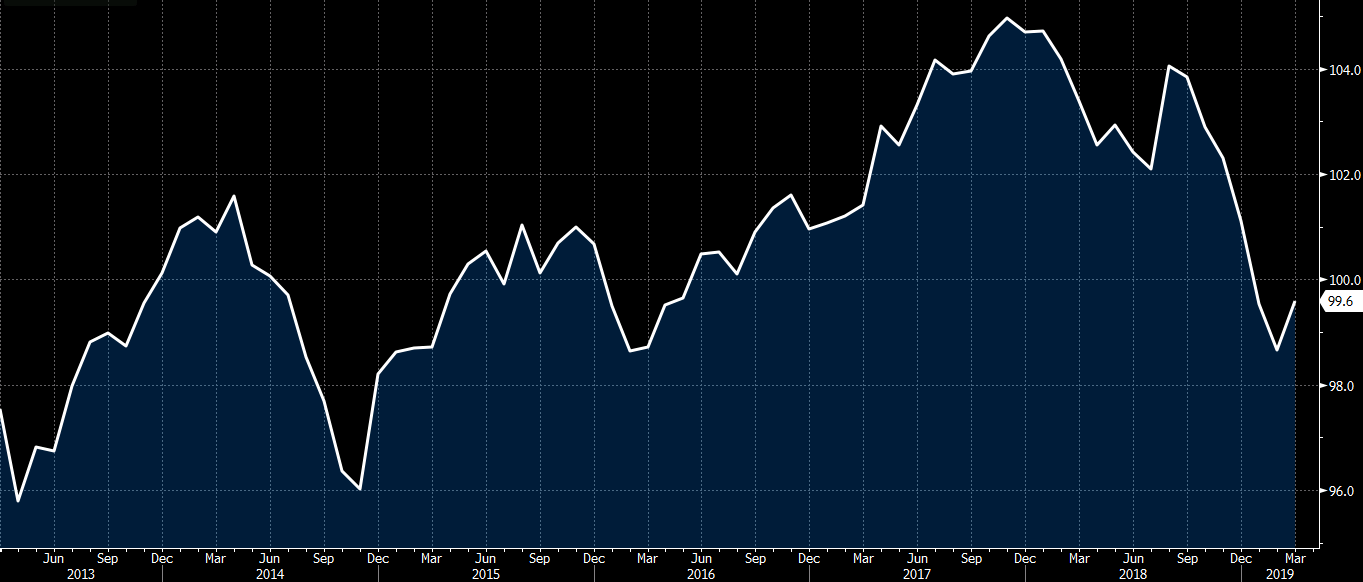

EM currencies were steadier on Monday however amid a broader dollar retreat. The JPMorgan Emerging Market Currency Index, having tumbled 1.7 per cent for its biggest one-day decline since last August on Friday, was 0.7 per cent higher.