Tokyo’s main index climbs on calmer risk tone in markets

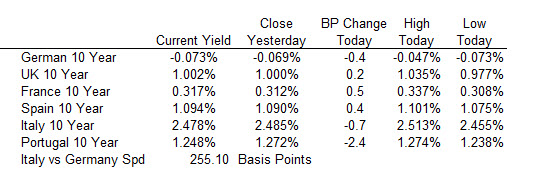

Asian equities are generally performing better on the day after a more composed session seen in Wall Street overnight. Bond yields are generally holding steady today as well and that is helping to see risk assets more stable ahead of European trading.

USD/JPY is holding a tad higher at 110.70 currently, off highs posted earlier around 110.93. Despite the slightly more optimistic risk tone and US-China continuing trade talks, there’s still a hint of caution in markets right now so just be wary that things could easily flip on its head in the coming sessions.