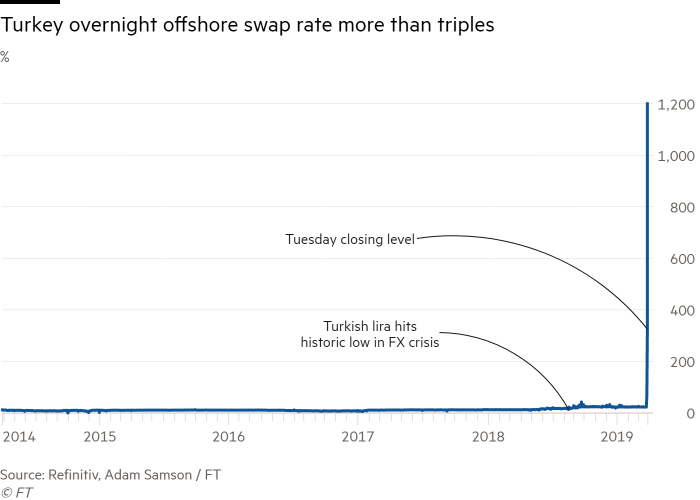

The cost to borrow Turkish liras overnight more than tripled to above 1,000 per cent on Wednesday in a sign of how money markets have seized up after an apparent bid to stymie foreign short sellers.

The offshore overnight swap rate, the cost to investors of exchanging foreign currency for lira over a set period, soared to 1,200 per cent, after hitting 325 per cent, the highest level since 2001, in the previous session. It was 22.6 per cent at the end of last week, Refinitiv data show.

The rising cost highlights what some analysts say is an attempt by Turkey’s government to arrest a decline in the lira, after the currency on Friday faced its heaviest plunge since the economic crisis during the summer of 2018. It rose both on Monday and Tuesday this week. On Wednesday, it repeatedly swung lower by two per cent before repeatedly picking up — an unusual pattern that suggests systematic buying. “The stress is hard to overstate,” said one Turkey-specialist at a European bank in London.

Another London-based analyst, who asked not to be named, said on Tuesday that Turkish banks were telling him they had been ordered “not to lend even a single lira to foreign counterparties”.

Turkey’s bond and equities markets also showed signs of rising investor angst. A dollar-denominated 10-year government bond maturing in October 2028 was trading with a yield of 7.63 per cent on Wednesday, from roughly 7 per cent early last week.

Lira-denominated paper has also suffered price declines, knocking yields higher. The benchmark 10-year yield was 18.1 per cent on Wednesday, having gone to as low as 13.8 per cent at the end of January.

The cost to hedge against a default of Turkish debt over a five-year period using credit default swaps swelled to 453 basis points from 352 bps at the end of last week.

Meanwhile, the benchmark Borsa Istanbul 100 stock gauge dropped 5 per cent on Wednesday, leaving it down 10.3 per cent over the past two weeks.

Esther Law, a senior investment manager for emerging market debt at the asset manager Amundi, said that the measures to curb short selling were “tactically supportive” for the lira but warned: “It’s not solving the problems and it’s definitely not helping the local bond market.”

Another emerging markets investor added that, by apparently “killing the offshore swap market, foreigners cannot easily hedge their lira bond positions.”

“That is shooting them in the foot again,” he said.

The launch of investigations by Turkish authorities over the weekend into JPMorgan, after the investment bank published a bearish report on the lira, has also largely dried out the flow of research, according to investors, creating a headache for some managers who use the reports. “I would rather not talk about Turkey. We are not allowed to talk about it at the moment and I’m sure you’re hearing the same from other banks as well,” said one typically chatty analyst at a European bank.

The recent bout of market volatility comes days before crucial local elections, scheduled for Sunday. Turkish President Recep Tayyip Erdogan runs the risk of losing control of Ankara, the country’s capital, and Istanbul, its largest city.

Sharp swings in the currency have added another economic worry for Turks, who are facing red-hot inflation and a sharp economic slowdown.

Also on the political front, Turkey’s foreign ministry announced that Sergei Lavrov, the Russian foreign minister, would visit the Turkish coastal city of Antalya on Friday to meet with his Turkish counterpart, Mevlut Cavusoglu.

The two men are likely to discuss Ankara’s plans to purchase a Russian S-400 air defence system from Moscow. Mounting tensions between the US and Turkey over the acquisition have unnerved investors, who fear that Washington will impose sanctions on Turkey, a Nato member, if it goes ahead with the purchase.