Archives of “March 21, 2019” day

rssUS sells 10-year TIPS at +0.578% vs +0.564% WI

Results of the 10-year, $11 billion sale of inflation-protected bonds

9-year, 10-month reopening

Bid to cover at 2.43 vs 2.42 prior

That’s a tad on the softside but the market is always struggling with TIPS.

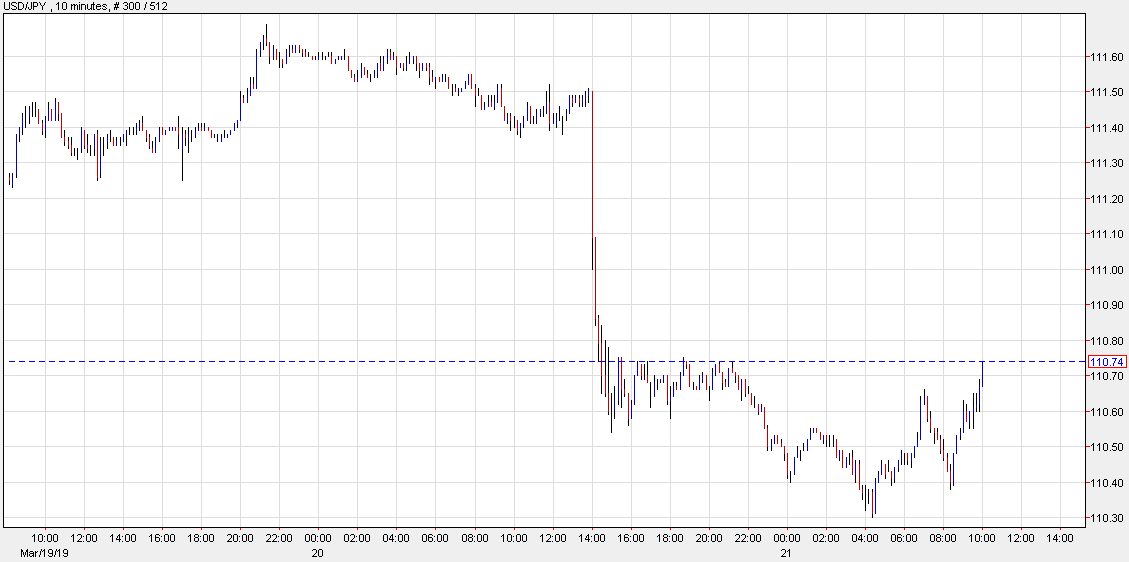

USD/JPY climbs as risk appetite improves

USD/JPY back to post-FOMC levels

Biogen to halt late-stage trial of promising Alzheimer’s drug

US pharmaceuticals company Biogen and its Japanese partner Eisai have announced they will cease clinical trials for a promising Alzheimer’s disease treatment, sending shares in Biogen tumbling by a quarter.

Nasdaq-listed Biogen and Tokyo-listed Eisai said in a joint statement they decided to discontinue a global Phase 3 trial of a drug known as aducanumab after a “futility analysis” conducted by an independent data monitoring committee indicated the trials were unlikely to succeed.

The drug had been applied to patients with mild cognitive impairment due to Alzheimer’s disease and mild Alzheimer’s disease dementia and had showed signs of promise after a favourable performance in mid-stage Phase 2 studies last year. The companies said the recommendation to stop the studies was not based on safety concerns.

Biogen had a market capitalisation of $63.1bn at closing bell on Wednesday and its shares were up 6.5 per cent year to date. In pre-market trading this morning, its shares were down 26.1 per cent.

BOE leaves bank rate unchanged at 0.75%; votes 0-0-9

BOE announces its latest monetary policy decision – 21 March 2019

- Prior 0.75%

- Official bank rate votes 0-0-9 vs 0-0-9 expected

- Asset purchase target £435 billion

- Corporate bond target £10 billion

- Underlying inflation broadly on track with forecast

- Employment growth could now moderate significantly

- Brexit could prompt policy moves in either direction

- Gradual, limited tightening still probably needed

- Monetary response to Brexit is not automatic and could be in either direction

- Brexit uncertainties continue to weigh on confidence, short-term economic activity

China says that imports, exports rebounded in March

More attempts to talk up the economy and calm investor worries

- Imports and exports trade are overall stable in Q1

- Says that Chinese companies front-loaded exports last year

China confirms that Lighthizer and Mnuchin to visit on 28-29 March

Comments by China’s commerce ministry

- China vice premier, Liu He, is to visit US in early April for more trade talks

- Says that Liu, Lighthizer and Mnuchin has had several calls recently

FOMC: Above Trend Growth Requires Continued Monetary Support

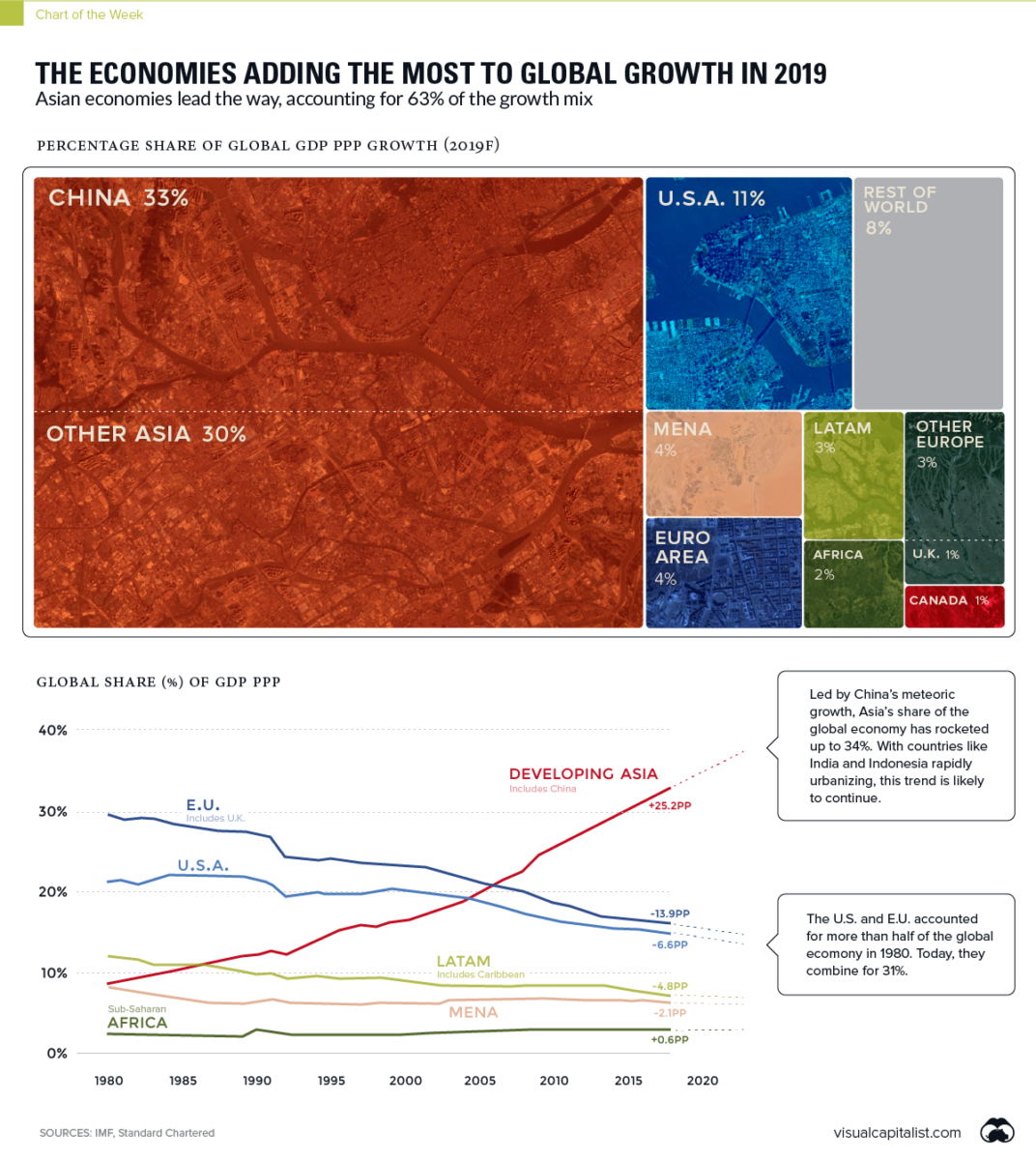

Economies Adding the Most to Global Growth in 2019

US Dollar Index finished lower for the 9th day in a row, tied for longest streak in history (data back to 1973). First close below 200-day moving avg since May 2018