Archives of “March 20, 2019” day

rssUS weekly oil inventories -9589K vs +1750K expected

Weekly US petroleum inventory and production data

- Prior was -3862K

- Gasoline -4587K vs -2500K expected

- Distillates -4127K vs -1500K expected

- Cushing -468K

- Production 12.1 mbpd vs 12.0 mbpd prior

- Crude -2133K

- Gasoline -2794K

- Distillates -1607K

- Cushing -317K

Quick jump in WTI to $59.60 from $58.96. For me, I would really like to see oil break $59.63 on this. That’s the 50% retracement of the Q4 rout and if it can’t break out on this kind of bullish news, I wonder if there’s anything that can push it over the top.

Quick Post on Board Games

I have renewed my acquaintance with checkers in the last 2 weeks. I find checkers much more a real exercise in logic than chess. The moves of a binary nature right or left duplicate the logic gates that go into all arithmetic operations of computers. The rules are very simple and thus correspond with extensions to all binary decisions in life. We all know that Tom Wiswell has written 5,000 proverbs covering the relations of checkers to life and they are invaluable and worth an extensive publication and study. However, what I have learned is quite rudimentary and not for all posterity like Tom’s. Briefly, here are some lessons:

1. Prepare before you play

2. Don’t move in haste

3. Play only certain lines and leave off playing when you don’t know

4. There is high frequency playing in checkers same way there is in our our markets. Don’t play against the high frequency but play for the 30 minutes games/ the high freq people have better equipment that you can’t compete against

5. Only play lines that you know and don’t wing it

6. Write your major plays down before hand and play them only

7. There are some players much better than you. Don’t compete with them

8. Your wins and losses tend to form clusters, i.e longer runs than expected. So don’t play after two losses in a row 8. Exercise before you play for at least 10 minutes

9. Study the play that was good 100 years ago and use it

10. Don’t do things by rote as things are always changing and your opp

11. The play in the morning is very different from the play in the afternoon. The players are different. I find checkers a good antidote to loss of memory and a good hobby which for me is resonant as my father played much with 10 Scotties and it brings back the glory days with my dad and Tom. Hobby for the old age.

Japanese government downgrades its economic assessment for the month of March

First downgrade in three years

In its latest monthly economic report, the Japanese government downgraded its view of the economy for the first time since 2016; citing recent weakness in exports and industrial production.

Nikkei 225 closes higher by 0.20% at 21,608.92

Tokyo’s main index closes slightly higher in a softer session for Asian equities

The Nikkei is bucking the trend on the day as equities are a tad softer in Asian trading, with Chinese stocks leading losses so far. Japanese stocks recovered from their earlier dip but gains aren’t really too notable as markets are cautious ahead of the FOMC meeting decision that is to come later today.

Oil gains remain capped by key resistance levels as OPEC+ kicks the can down the road

No OPEC+ decision on production cuts extension until June

China’s President Xi to visit France – will sign deals while there

To sign agreements to include energy, transport, agriculture

- USTR: US officials said to see China walking back trade offers

- China says it wants more synergy with EU on belt and road

Reuters Tankan: Japan manufacturers sentiment at its lowest since October 2016

The Reuters Tankan is a monthly survey, ahead of the BOJ’s quarterly of the same name (due April 1).

Headlines via Reuters:

March manufacturers’ sentiment index +10 vs Feb +13

- Service-sector index +22, unchanged from Feb

- Business sentiment seen inching up ahead

- Reuters Tankan points to worsening BOJ tankan

The manufacturing index back to its lowest since Oct 2016

- confidence fell for a fifth straight month

“Our clients are turning cautions on capital expenditure due to the U.S.-China trade war, spreading protectionism and political jitters in emerging countries,” a manager of a machinery maker wrote in the survey.

Reuters poll of 479 large- and mid-sized companies

- completed by 250 firms

- over the March 4-15

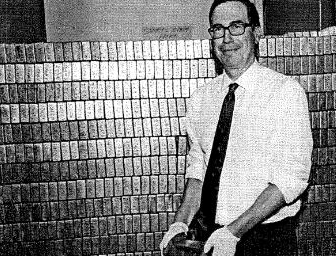

Hedge Fund says it has spotted the ‘trade of the century’ (spoiler: buy gold, sell stocks)

The ‘trade of the decade’ is getting a bit old hat …. here comes the ‘trade of the century’!

- reasoning is risk assets are due for another meltdown

- corporate insiders currently selling stocks ‘hand over fist’

- U.S. economic data is deteriorating

- inversions remain across the Treasury yield curve … “The last two times the credit markets had such a high distortion, asset bubbles began to fall apart shortly thereafter,”

‘Mmmmm, gold’

‘Mmmmm, gold’

The US stocks end the session mixed

FedEx misses on top and bottom after the close

- The S&P was nearly unchanged (down -0.37 points or -0.01%) at 2832.57. THe high reached 2852.42. The low extended to 2823.27

- The Nasdaq rose 9.467 points or +0.12% at 7723.94. The high reached 7767.89. The low extended to 7699.156

- The Dow closed down -26.72 points or -0.10% at 25887.38. The high reached 26109.89

- earnings came in at $3.03 which is lower than the $3.11 expected

- revenues came in at $17.0 billion versus $17.67 billion estimate

- the stock price is down 3.8% in after-hours trading at $174.50

- Nvidia, +4.0%

- Micron, +1.92%

- Broadcom, +1.6%

- Pfizer, +1.24%

- Alphabet, +1.23%

- Celgene, +1.23%

- Amazon, +1.13%

- Walgreens, +1.094%

- Adobe, +1.03%

- J&J, +0.94%

- Gilead, +0.72%

- Facebook, +0.69%

- Disney, -2.66%

- Deutsche Bank, -2.38%

- PNC financial, -1.8%

- travelers, -1.49%

- Netflix, -1.28%

- Verizon, -0.95%

- General Mills, -0.82%

- Apple, -0.79%

- American Express, -0.76%

- Goldman Sachs, -0.65%