EUR/USD sits in a 7 pips range so far today

Yup, that is no joke. The pair is only trading between 1.1283 and 1.1290 as there isn’t much volatility in the major currencies space so far today. Price continues to languish just under the 1.1300 handle as buyers continue to try and establish a more bullish near-term bias but is finding resistance around the figure level tough to break above.

Currently, there is the 200-hour MA (blue line) @ 1.1290 and mild offers as well as

large expiries sitting at the 1.1300 handle that is helping to limit gains for the pair. Meanwhile, price is holding just above the 76.4 retracement level of the ECB drop with buyers looking poised to keep price above 1.1280.

With several key levels hovering around 1.1290-00, that should be a notable attraction level ahead of the US core durable goods orders data later; one that should offer traders something to react upon. For buyers, establishing a move above the 200-hour MA and the 1.1300 handle is key for an extension to the upside.

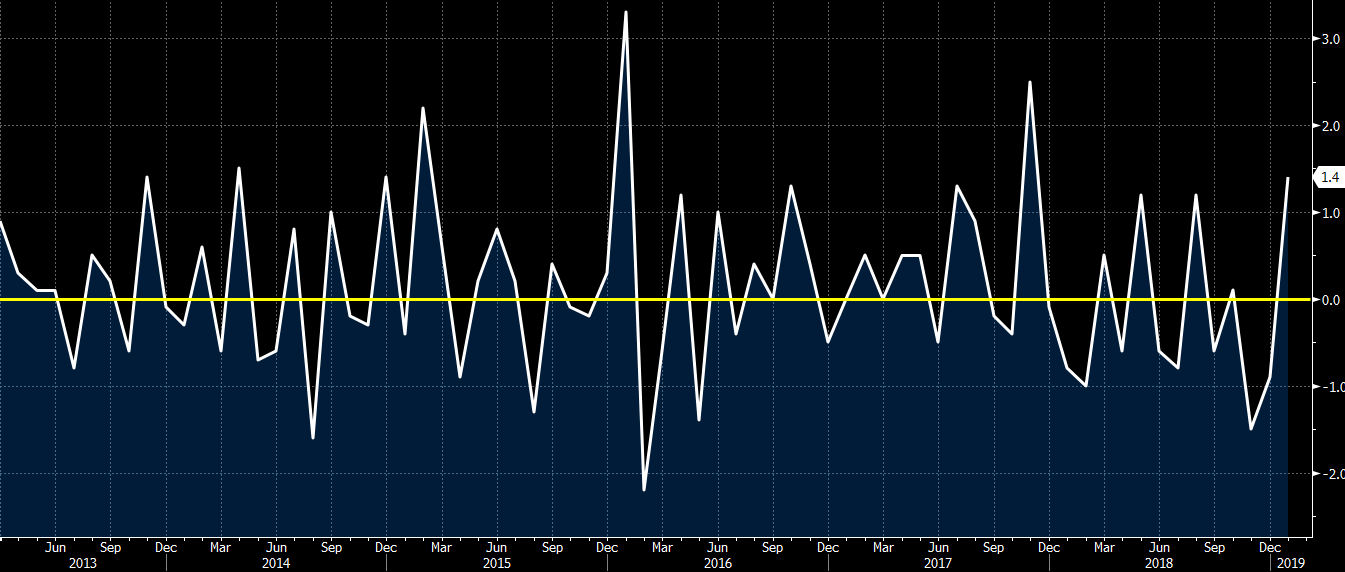

Despite the ECB’s recent dovish shift, the one thing that the euro has working for it is perhaps positioning data. CFTC’s latest report (as of 5 March) indicates that euro shorts have been the most stretched since December 2016 and that is something that could help to work in the single currency’s favour as sellers look to square some of their positions following a large event like the ECB last week.