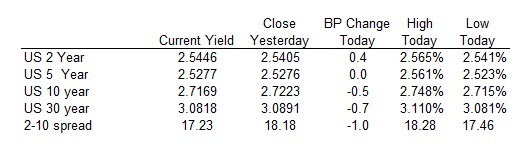

10 year yields are lower

- The German Dax, -0.26%

- France’s CAC, -0.06%

- UKs FTSE, +0.18%

- Italy’s FTSE MIB, up 0.65%

- Spain’s Ibex, +0.46%

This report isn’t as bearish as the API numbers yesterday. Crude is bouncing on the headlines back to $55.80 from $55.55 beforehand.

Former Nissan chairman to leave jail as soon as Wednesday upon paying $9m bail

Former Nissan Motor Chairman Carlos Ghosn is set to be released from jail as early as Wednesday morning after the Tokyo District Court rejected prosecutors’ appeal to keep him in custody late Tuesday night.

After more than 100 days in detention, Ghosn’s third request for bail gave his new defense team a welcome victory as they prepare for his trial in the autumn on charges of financial misconduct.

Ghosn will be released as soon as he pays the 1 billion yen ($9 million) bail set by the court. The former auto executive is banned from traveling abroad or contacting anyone related to his court case out of concern that evidence could be destroyed.

Chinese Premier Li Keqiang was conspicuously silent on the “Made in China 2025” initiative as he spoke at the opening session of the National People’s Congress, the country’s parliament, on Tuesday, in a likely acknowledgment of harsh U.S. criticism against Beijing’s pet industry-building program.

This is the first time Li stayed silent on the program in his annual report to the congress since 2015, when he first introduced it. He mentioned it twice in last year’s report. Other top officials and state news media have already been shying away from the topic for some time.

Made in China 2025, a state-led industrial policy that seeks to make China dominant in global high-tech manufacturing, has come under fire, not least for its massive government subsidies to its industries. It is one of the key sticking points in China’s trade talks with the U.S.

But the shedding of the 2025 plan could be in name only. In his 100-minute-plus speech, Li touched on many aspects of Made in China 2025, including pledging to invest heavily in emerging industries such as next-generation information technology, high-end equipment, biomedicine, and new energy automobiles. (more…)

The head of the US Food and Drug Administration will step down from the post in a month’s time, President Donald Trump confirmed, after nearly two years in the role.

Scott Gottlieb has led the FDA as it tackled problems ranging from teenage vaping and opioid abuse and undertaken efforts to rein in the rising cost of prescription drugs.

The news comes just two months after the former physician publicly denied reports he was planning to step down from the role of commissioner, saying in a tweet the FDA had “a lot of important policy we’ll advance this year” and that he looked forward to “sharing my 2019 strategic roadmap soon”.

Mr Trump confirmed Mr Gottlieb’s departure on Twitter on Tuesday afternoon, saying he had “done an absolutely terrific job”.

“Scott has helped us to lower drug prices, get a record number of generic drugs approved and onto the market, and so many other things. He and his talents will be greatly missed!” the president added.

In a two-page resignation letter obtained and published by Axios, Mr Gottlieb pointed to some of the FDA’s efforts over the past 23 months and said he was “fortunate for the opportunity that the President of the United States afforded me to lead this outstanding team, at this time, in this period of wonderful scientific advances.”

News of Mr Gottlieb’s impending resignation was reported earlier this afternoon by The Washington Post.

Shares in US-listed cigarette makers Philip Morris International and Altria both spiked higher on the initial Washington Post report, but quickly reverted to where they were trading before the news broke.