“I believe that truth is healthy and that most people can get what they want if they understand what is true and learn how to successfully deal with it. But I recognize that some people have problems applying this to their and others’ mistakes and weaknesses. That is because there commonly exists a stupid paradigm that “successful” people don’t make mistakes and don’t have weaknesses, whereas the truth is that everyone makes mistakes and has weaknesses. I believe that most important difference between “successful” people and “unsuccessful” people is that the successful people recognize their mistakes so that they learn from them and they recognize their weaknesses so they develop strategies to get around them.”

“I believe that truth is healthy and that most people can get what they want if they understand what is true and learn how to successfully deal with it. But I recognize that some people have problems applying this to their and others’ mistakes and weaknesses. That is because there commonly exists a stupid paradigm that “successful” people don’t make mistakes and don’t have weaknesses, whereas the truth is that everyone makes mistakes and has weaknesses. I believe that most important difference between “successful” people and “unsuccessful” people is that the successful people recognize their mistakes so that they learn from them and they recognize their weaknesses so they develop strategies to get around them.”

Latest Posts

rssThought For A Day

Quotes from :Way Of The Turtle' by Curtis Faith

Here are some stories startups tell about themselves. What are some others?

25 Trading Mantras

Seeing an opportunity and acting upon it are two different things.

Seeing an opportunity and acting upon it are two different things.

• Price has memory. Odds are what price did the last time it hit a certain level will be repeated . . . (BR: Until support or resistance fails).

• Pay attention to price action, regardless of what the charts are saying.

• Look for a reversal at the same place you’re expecting a breakout or breakdown.

• Price action sets up against the majority; the best profits are often in the opposite direction of the way you’re planning to go.

• Add to your winners and cut your losers. ’nuff said.

• Opportunities come along all of the time. Wait for the best ones.

• Don’t overly anticipate or see things that aren’t there. Wait for your signals. (more…)

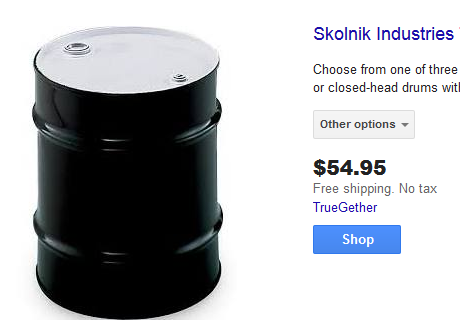

When the barrel costs more than then oil

Improving Performance

A Common Misconception

We’ve all heard it before: You just need more winning trades than losing trades in order to be profitable….

Wrong.

There’s a common misconception out there that more winners than losers automatically results in a profitable account. I personally don’t think that’s the case at all. In fact, the more important thing to worry about is how big those losers are relative to your winners. You can have more winners than losers but have your losers result in massive drawdowns that your winners can’t make up for. I can’t begin to tell you how many horror stories I’ve heard about just 1 or 2 trades completely ruining a portfolio filled with all these other winners. So to me, I believe that as long as you keep your losers small, you can have plenty of them and still keep an extremely profitable account.

And this really just plays into the importance of risk management. I know I harp on this a lot, but it’s so true. The only thing that matters is managing your risk. I don’t care how you come to your conclusions. It’s irrelevant. And I get nasty emails sometimes from people disagreeing with my methodology. But the truth is, who cares how we come to our conclusions? Balance sheets, income statements or lunar cycles – it doesn’t matter to me. I just want to know where we’re wrong. At what price is the original thesis incorrect? And therefore, how much are we risking to put on this position? (more…)

Terrifiyingvideo from a skier at base-camp – warning – expletive-strewn…The Mount Everest Avalanche

Book Review :Risk Management in Trading -by Davis Edwards

It is a commonplace that risk management is critical to trading success. What constitutes good risk management, however, is anything but commonplace knowledge. Was VaR the number that killed us, as Pablo Triana claimed, or is it a useful, perhaps even indispensable, tool? Should risk management teams have their separate turf or should they be integrated with the trading desks? And what do you have to know to be a risk manager?

Davis W. Edwards addresses all of these questions, with particular emphasis on the third, in Risk Management in Trading: Techniques to Drive Profitability of Hedge Funds and Trading Desks (Wiley, 2014). The book is a useful self-study guide for those who aspire to become risk managers; each chapter ends with a set of questions to test the reader’s knowledge, and there is an answer key at the back of the book. It also goes a long way toward satisfying the curiosity of those who want to know just what it is that risk managers really do. It does not, however, directly address the concerns of the individual trader who wants to incorporate sound risk management principles into his business model.

After three preliminary chapters (on trading and hedge funds, financial markets, and financial mathematics) Edwards gets to the heart of the matter. He discusses backtesting and trade forensics; mark-to-market accounting; value-at-risk; hedging; options, Greeks, and non-linear risks; and credit value adjustments (CVA).

To give you a better sense of the level of the book—and so you can test your own skills—here are a few questions from the quizzes.