- “The paradox is realizing that being in control is about letting go.”

- “Even if you give your investments to others to manage, you are wholly responsible for that decision.”

- Letting go of your ego doesn’t create self-esteem. In order to trade soundly, you must lose your ego AND replace it with sound, prepared, professional judgment.

- The conscious mind assembles the data. The unconscious mind notices the patterns, makes the connections and guide your judgment.

- “The depth of your emotional resources is as important as your finances.”

- “The market is a collection of beliefs.”

- There is no content, only context.

- “If we ever fought battles, the main opponent was ourselves.”

- “If you persistently adopt someone else’s view, expect their performance. In that case, why don’t you just put the money into one of the thousands of funds and crystallize your implicit delegation of responsibility.”

Archives of “January 2019” month

rssThe chapters detailing the camping trips of Henry Ford, Thomas Edison, Firestone, and Burroughs are pure gold

The Reversing Arrow illusion

From The Art of Mental Training:

Don't believe everything you read in the press…

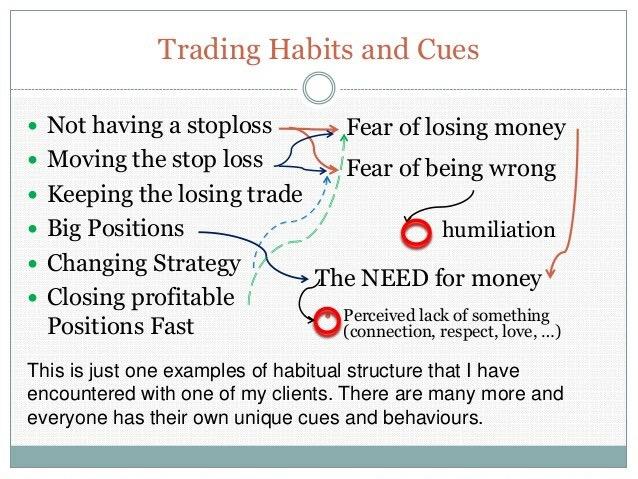

Bad trading habits & Cues

Toovar Dal. The comfort food element. Causing discomfort to everyone.

Lessons from Richard Bernstein, David Rosenberg,Bob Farrell

Richard Bernstein’s Lessons

1. Income is as important as are capital gains. Because most investors ignore income opportunities, income may be more important than are capital gains.

2. Most stock market indicators have never actually been tested. Most don’t work.

3. Most investors’ time horizons are much too short. Statistics indicate that day trading is largely based on luck.

4. Bull markets are made of risk aversion and undervalued assets. They are not made of cheering and a rush to buy.

5. Diversification doesn’t depend on the number of asset classes in a portfolio. Rather, it depends on the correlations

between the asset classes in a portfolio.

6. Balance sheets are generally more important than are income or cash flow statements.

7. Investors should focus strongly on GAAP accounting, and should pay little attention to “pro forma” or “unaudited” financial

statements.

8. Investors should be providers of scarce capital. Return on capital is typically highest where capital is scarce.

9. Investors should research financial history as much as possible.

10. Leverage gives the illusion of wealth. Saving is wealth.

David Rosenberg’s Lessons

1. In order for an economic forecast to be relevant, it must be combined with a market call. (more…)

6 Trading Sins

1. Thinking that trading is a get-rich-quick scheme.

2. Reacting emotionally to market movement instead of assessing the market rationally using proven methods for high probability trades.

3. Chasing the Market.

4. Lack of preparation – entering the market with little or no understanding of what the probabilities are and how to handle them. Being unaware of special events or announcements that may be big marketmovers.

5. Butterfly Trading. Trying one method after another without mastering any.

6. “Go-it-alone” Syndrome, hoping to discover the ‘secret code’ for trading. Most successful traders have learned from other successful traders. This can eliminate years of trial and error, and some very painful trading losses.